- Financial Services

- 2 min read

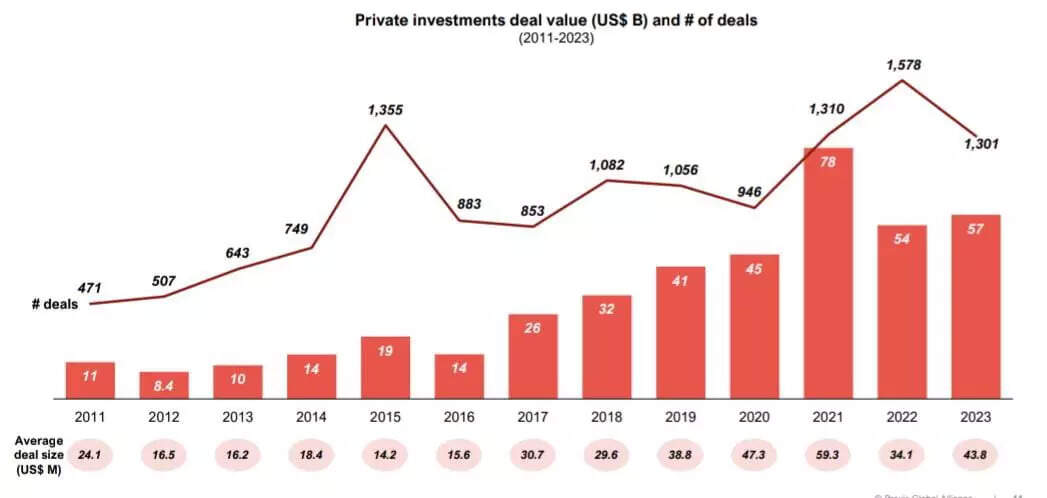

Indian private investments maintain momentum, $57 bn raised across 1301 deals in 2023: Report

The Private Capital industry globally has faced challenges, including inflationary pressures, concerns of heated valuations, slowdown in the internet economy, and uncertainty brought on by geopolitical factors. This has impacted investments, exits, and fundraising globally in 2023. Despite this, 2023 saw resuscitation from the downfall seen in the second half of 2022 with dealmaking value seeing an upward trend as compared to 2022 in India, according to a recent report by Praxis Global Alliance.

2023 saw resuscitation from the downfall seen in the second half of 2022 with dealmaking value seeing an upward trend as compared to 2022 in India. This was backed by growth in Private Credit deals & PIPE transactions and increase in the number of larger deals with check size more than USD 500 million.

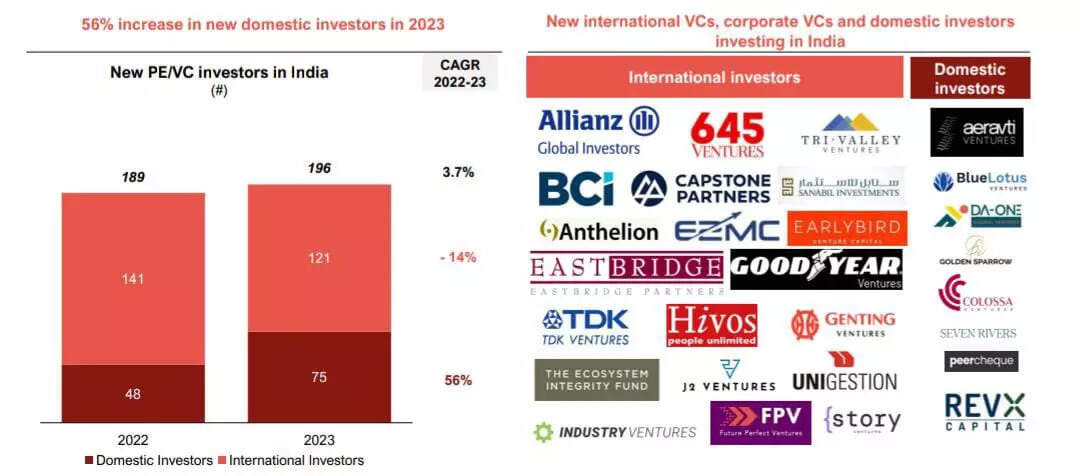

Private investment deal value in 2023 increased by 6 per cent as compared to 2022 marking an end to downfall seen after the 2021 euphoria in Consumer internet investments. Funding frenzy towards consumer apps and e-commerce platforms tempered in 2023. Investors remain bullish on the India growth story with global LP allocations to India expected to increase in 2024 and beyond, said the report.

Global investments are flowing into the country’s economy. FDI dropped to USD 71 billion in FY23 from an all-time high of USD 85 billion in FY22. FPI investments rebounded in FY24, overturning two years of negative trend. ECB inflows witnessed a rise in FY24

after a dip in FY23.

The report further highlighted the abundant dry powder in the market, a thriving startup ecosystem, and that rising exits will boost private investments in India. Amid global downturn, investors have slashed valuations of startups to correct their valuations, the report said.

India-focused private investment funds currently hold a record-high dry powder of approximately USD 20 billion, with increasing pressure to deploy investments. It was a buoyant year for India-dedicated fundraising as PE/VC funds secured USD 16.5 billion in 2023. Private investments are driven by energy & renewables, engg. & construction, real estate, healthcare & life sciences and BFSI, the report further highlighted.

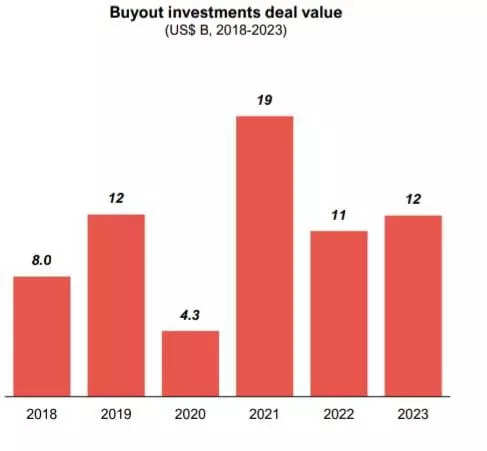

There has also been a notable increase in buyout deals, constituting USD 12 billion in 2023, driven by conglomerates restructuring, platform creation, and operational enhancements.

Share of PE/VC buyouts is also increasing in India. PE/VC investments enable conglomerates to focus resources on core businesses, enhancing efficiency and profitability. PE/VC-backed buyouts facilitate the creation of platforms for product diversification and leveraging synergies.

BFSI and healthcare & life sciences sectors saw maximum exits in 2023. Exit value bounced back to USD 293 billion from a drop in 2022, with IPOs continuing to be the top choice for exits. Public market exit activity reached an all-time high of USD 14 billion in 2023, the report added.

ETBFSI now has its WhatsApp channel. Join for all the latest updates.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions